Complexities of an island

Hub or prison?

An island that is not a hub, is a prison. What is Curaçao now? This is the question for the coming weeks, months. The root of Curaçaos attraction as a colony lies in its position as a harbour and possible trading hub. During its existance as a harbour, many nationalities set up business here. Now there is an emphasis on 'Curacao for the real Curacaoan'. What does that mean? What is Curaçao. Is it an international businessmodel for everybody that wants to invest and live here? Is Curaçao the place you are born and leave when you grow up? Is Curaçao a nation or an off shore construction with tourism?

sombra di por/ shadow of power.

After watching the documentary sombra di koló, shadow of Color, something kept bothering us. In the documentary the only examples given of discrimination are those between people of color. Even within families the darker sibling would feel uglier. Would try to be extra good and extra sweet to compensate. A thing confirmed by people we met: Jokes were made about the darker sibling that they were 'found in a box'. The person in the documentary fled to the Netherlands to get away form this feeling. School children calling each other tar, charcoal. So even when there is no white person there, the concept is clear: black is bad.

It would be wrong to think though white is good. White is not good. As the politician Herman Wiels said, whose party won the last elections on Curacao: if they (the Dutch, the macambas) think they can dictate us we will send them home in bags. As a member of the audience said, it is not so much about color but about class. White is not beautifull, it has power, wealth. . White is strong. So the whiter you are, you look closer to power. You have better chances on a good job. A good marriage.

But now the days of white dominance are gone. Or are they? We get mixed signals. Politics are non white. Police isn't. But maybe the power behind the power is? But is that about color, or just about power?

sombra di koló/shadow of color

One of the more lucrative trades of the West India Companie was the slave trade. People were bought as slave in Africa and shipped to Curacao where they were sold to plantation holders in the region. But not immediately. After the harrassing trip over sea some needed to get more healthy. During this period they worked on the plantations of the W.I.C. Some of the captured Africans stayed or were bought by other traders on the island. During the centuries many children of mixed race were born. This resulted in a population of every shade of skin.

Skin color is still an issue on Curaçao. Untill recently 'black' hair was considered bad hair and straightened to become 'normal'. Nowadays many women 'go natural 'and just accept and like their hair as it is: curly. Even though some businesses here still prefer their employees to have neat=straight hair.

The issue of color is the subject of the documentary of a Dutch-Curacao antropologist. Last saturday we watched this document: Sombra di Koló.

-

Skin color illusion

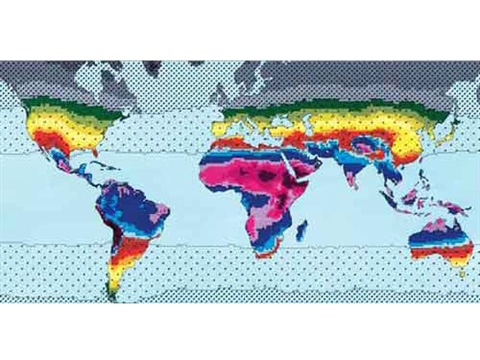

The scientist Nina Jablonski did ground breaking work on the evolutionary causes for different skin colors. In short: its all about UV radiation. Enlightening and watch worthy!!

-

Skin color chart

Your skintype is important when it comes to knowing how to deal with UV. Check what type you are. And prevent skin cancer or vitamin D deficiency.

-

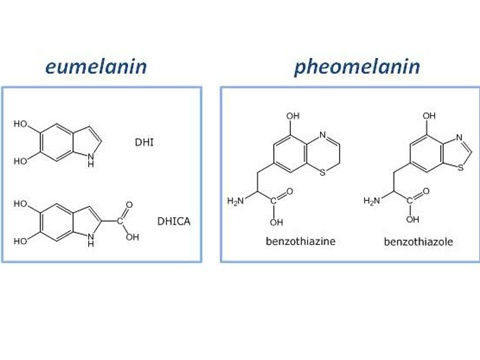

Melanine

Melanine is the stuff that causes pigmentation. What type of melanine is dominant in your skin oudetermines what color skin you have.

skin deep, documentary on color

Great! Changes your outlook! Thank you Nina Jablonski!

solidarity piracy

What kind of business is Off-Shore banking or tax evasion constructions? Basicly it is solidarity competition. The taxes in a country more or less show how the solidarity principle is founded in society. High taxes generally mean high level social security and public services. Offering companies a possibility to evade taxes in the country they do their business is disruption of the solidarity principles of that country.

The recent conviction of Starbucks for tax evasion in Great Britain through Dutch tax construction is a good example of this practice. Allthough Starbucks was following the rules, the rules themselves were seen as manipulated to make an irregular tax advantage possible. Starbucks didn't make these rules but knowingly co-authored tax evasion.

The interesting part is that this kind of solidarity piracy is again mastered by the Dutch. Coming from a long tradition since Piet Hein who stole the silver of the Spanish. The silver which helped founding the West Indië Companie that conquered Curaçao for trading purposes. Solidarity was not a concept then. Profit and loyalty were the guiding principles.

check this for British Carribean connection: http://www.theguardian.com/world/ng-interactive/2014/jan/21/china-british-virgin-islands-wealth-offshore-havens

privateer...

Ships from the West Indische Companie were privateers, a right granted by the Dutch government after the war against the spanish was unsuccesfull. This right made it possible to pirate the silver of the spanish Armada.

from wikipedia:

A privateer (sometimes called corsair or buccaneer) was a private person or ship authorized by a government to attack foreign vessels during wartime. Privateering was a way of mobilizing armed ships and sailors without having vessels be commissioned into regular service as warships. The crew of a privateer might be treated as prisoners of war. by the enemy country if captured.

Historically, the distinction between a privateer and a pirate has been subjective, often depending on the source as to which label was correct in a particular circumstance.The actual work of a pirate and a privateer is generally the same (raiding and plundering ships); it is, therefore, the authorization and perceived legality of the actions that form the distinction. At various times, governments indiscriminately granted authorization for privateering to a variety of ships, so much so that would-be pirates could easily operate under a veil of legitimacy.

-

Penshonado?

Besides companies there are also people that enjoy the tax climate in Curacao. The (Dutch) penshonado.

When you are retired and buy a house on the island ( minimum value 450.000 AG) and live here you're savings and income will only be taxed with 10%. -

Or over 50?

You can not work on Curacao with this regulation there is an exception for being a Comissioner or governor of a company. This you can keep doing. And, as you now are under the tax rules of Curacao, the 10% is applied also on your earnings from companies you have in other countries.

-

Income Tax

Individual income tax rates in the Netherlands Antilles are progressive from 10% up to 38%. A surtax of 25% or 30% also applies. So the final amount is 45,5 %. Unless you are a penshionado, 10 %, or a company with special status: 2-4 %.

-

tax in payment

Percentage of wages going to pension payments is 16%, 9,5 % paid by employer, 6,5 % paid by employee.

-

wealth tax

Curaçao doesn’t levy wealth tax on the assets of its residents. Both inheritance tax and gift tax apply (rates vary between 2% and 24%) to the assets of a resident of Curaçao (but there are possibilities to avoid these taxes of course).

Dutch Admiral PIET HEIN:

http://www.britannica.com/biography/Piet-Heyn

west indische companie

https://en.wikipedia.org/wiki/Dutch_West_India_Company

https://nl.wikipedia.org/wiki/West-Indische_Compagnie

Starbucks Dutch tax

-

tax & illegal workers

Of course you cannot tax the wages of an illegal alien. But you can tax the things everybody uses to sustain themselves: food, products, petrol and electricity. ..

-

.........

The percentages of sales tax (OB) on luxury goods have been raised from 6 to 9 % in 2013. But no tax on water, gas and electricity, basic foods, medical services, public transport and non-commercial goods and services. In comparison: Sales tax in the Netherlands is 6 % on basic needs, 22% on luxury goods and services and 75% on petrol and alcohol.....

can you afford your economy...

In the Netherlands tax pressure is 43,3 %. In Colombia 39%, the USA 17 %, but in Curaçao 16,6%. The business of low taxing is called offshore baning and is an important serrvice on Curaçao.The term off shore originates from the Channel Islands, famous for low taxes, being off shore from Great Britain. Allthough not every tax haven is 'off shore' the name stuck.

What is the advantage of off shore construction. For a company residing here dividend taxes are 0%. For companies having an address here it is 5 %. That is low. Not only businesse but also individuals can open bank accounts here. To avoid taxes in your own country. Ofcourse that is illegal. But when there is no information being exchanged it is very possible.

Curaçao

was on the tax haven list, but now complies to international standard. It has signed a special treaty with the Netherlands to raise the tax level to 15 % in 2019. But according to the experts: Companies with sufficient substance/activities on Curacao can

however benefit from the 0% withholding tax rate on dividends if they meet the conditions.

The Netherlands by the way are known for their lucrative tax construction by so called post box firms. And critised for it because by offering tax evasion possibilities you stela taxes from other countries.

Recently the Maduro Curiel Bank ws the first Caribbean bant to rank in the top 20 offshore banks. https://www.streber.st/2014/01/the-best-offshore-banks-2013/

But was is the problem with all this? You guessed it: Low taxes, so, a gouvernment has not much to spend while having normal costs.

(in) dependance

When we look at the economic-figures a few things strike us: first, agriculture is almost non existent. Only 1,2 percent of GDP (Gross Domestic Product) comes from agriculture. Mostly from growing agave. For food Curacao is almost entirely dependent on import. Secondly the role of service: 81,8%. These services are mostly connected to tourism and financial services. This shows the dependency on visitors from abroad.

The third factor is oil. The refinery ISLA is responsible for 7% of income. In the hayday of Shell that used to be 45 % share. So industrial production is declining, and service economy is growing. Being a hub, a host: you depend on it.

The labour force making it possible is for a big part illegal. Cleaning, serving is mostly done by South American ladies. Also working on the land, building, simple mechanical work. It means that -de facto- you can not afford your own economy. The shadow-economy is large and influential.

-

Economy: Income

agriculture: 0.7%

industry: 15.5%

services: 83.8% -

Employment

agriculture: 1.2%

industry: 16.9%

services: 81.8%

legal labor force: 73,010

illegal (estimated) 50.000

unemployment 9400 (2013) -

Income

GDP $ 15.000 per capita (2004)

There are no more recent numbers.

By comparison The GDP in Venezuela in 2004 was $ 5,435.9, now $12,265.00

The Netherlands in 2004 39.140, now 51,590.0

Representational power of democracy....

The ratio of voter to inhabitant is 1 to 2: for every voter there are 2 people that will not or can not vote. No problem: many countries have the same ratio. When you have children you represent them as well. But in Curacao this is not the case. The unrepresented are not your next of kin (family) but people you don't know. Worse: here the unrepresented are people that are often disliked or seen as a bad influence on Curacao. Illegal workers and the Macamba, the white people. The vote is often directed against the unrepresented. One can imagine that this creates tension on the island.

-

no use for the economy

"Because these south amerricans, they come herre, they say: I sent money home. THere are many people coming from neighbouring countries to work here because wages are considered hig, compared to wages at home.

Most illegal workers work in menial jobs, serving, cleaning. They do the jobs locals don't want to do or are too expensive to do. Because off this there is a huge black money circuit. They cannot be taxed. But do make use of public services... -

illegal housing

They rent cheap. They are of no use to local economy.". Illegals rent as cheap as possible from locals. And pay large sums for bad housing. It is no problem to get water and electrictiy when you are illegal.

-

ungrateful

And when they are legal and get a pension here, say after 20 years of working that is 600 AG, they build a house over there and are rich there.

In 2010 3500 workers could apply for a permanent working permit. Some get partners here, marry, and get a legal status. This is also a cause of discontent: the children from former marriage can get legal status too. Man are 'lured' in a marriage.

reads

Economy in numbers:

http://www.theodora.com/wfbcurrent/curacao/curacao_economy.html

complexities of legalisation

http://curacaochronicle.com/judicial/sex-tourism-and-trafficking-in-the-dutch-caribbean/

black economy

http://curacaochronicle.com/columns/land-grabbing-on-curacao/

Who takes care of Curaçao?

The ratio of voter to inhabitant is 1 to 2: for every voter there are 2 people that will not or can not vote. No problem: many countries have the same ratio. When you have children you represent them as well. But in Curacao this is not the case. The unrepresented are not your next of kin(family) but people you don't know. Worse: here the unrepresented are people that are often disliked or seen as a bad influence on Curacao. Illegal workers and the Macamba, the white people. The vote is often directed against the unrepresented. One can imagine that this creates tension on the island.

-

voters/ nonvoters

The latest census of 2011 on Curacao shows a number of 149.679 inhabitants. Legal citizens that is. Because Curacao has a large number of illegal workers, mostly from neighbouring countries like Dominica, Haiti, Venezueala and Colombia. A number of about 50.000 people is estimated . Off course these illegal workers can't vote.

-

More non voters

Of course there are more people non residents. Tere are 5000 Dutch working and staying on the island.

Exact numbers are hard to find, because also those born Curacao have the Dutch nationality. There are people staying here part time, or apprentice on a short working permit. -

Tourists

On any day on the island there are on average of 10.000 tourists present that also stay the night.

When you add it all up the real number of inhabitants is probably 50% higher than the official number: 225.000 in stead of 150.000. Curacao has 116.00 registered voters. About 65 %, 85.000, voted in the last 2012 elections.

So if we do the maths, for every voter there are 2 people that do not want to or can't vote.

number of inhabitants

amount of tourists

http://www.curacaotoerisme.nl/land-informatie/statistieken/

number of illegal workers

number of voters

Meest recente reacties

ik zou graag illen weten wie de oudste geborernde in levenzijnde mogonees is

Dag Bart en Klaar!

Wij hebben jullie ontmoet bij de radio uitzending Kunst is Lang.

Ik vroeg me af hoe ik met jullie in contact kan komen in de toekomst! werkt het op deze manier? groet Eva

super trip for you , thank you beri beri much four sharing with us fans.....many greetings and best wishes to you and your loved ones...

Beste Bart en Klaar, Ik verblijf nu op Moengo en ik vroeg me af waar jullie je informatie over stafdorp en happyland etc vandaan hebben gehaald want daar zou ik graag nog meer over lezen! Alvast dank